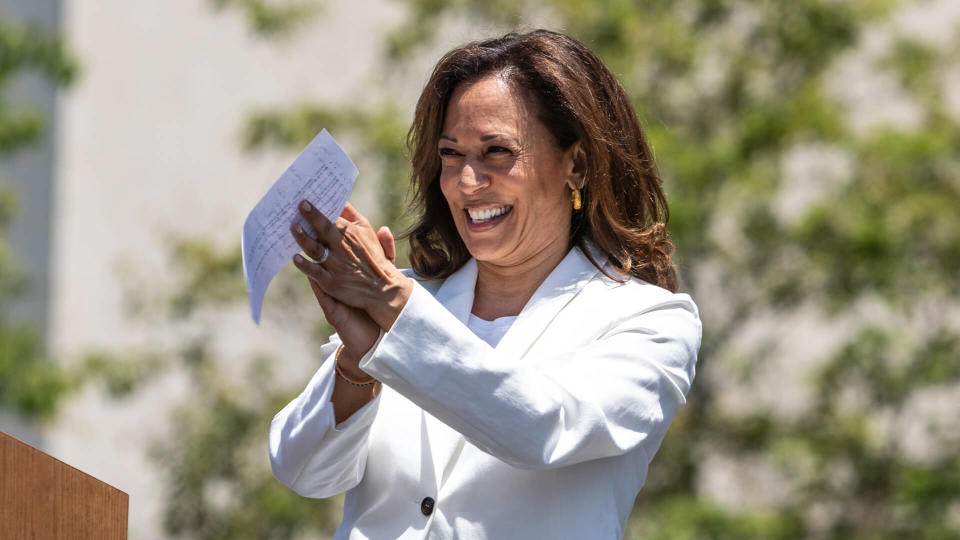

Americans will elect a new president in November — and it might be Kamala Harris. Since she is currently the vice president, a Harris win might not shake things up as much as a Trump victory, but any new leader inevitably brings some level of change.

Also inevitable is the impact a new president can have on your finances. Now is the time to start preparing for the transition, to safeguard your assets.

Read Next: Trump Wants To Eliminate Income Taxes: Here’s What That Would Mean for the Economy and Your Wallet

Find Out: 7 Reasons You Should Consider a Financial Advisor — Even If You’re Not Wealthy

“Much of the proactive planning will focus on the Tax Cuts and Jobs Act, which is due to sunset at the end of 2025,” said Steven Calio, CFP, co-founder and financial planner at CSG Financial. “It is likely that if Harris gets elected, she will take a similar stance to Biden and not renew a majority of the TCJA.”

He said this would increase tax exposure to most families, especially high-earning households with annual incomes of more $300,000. Even if you don’t fit into this category, it’s still a good idea to get your finances in order before Biden transitions out of the White House.

There’s no way to know who will win the presidency until November 5. However, if you think Harris will become the first woman president, here are six financial moves to start making now.

Retirement Planning: Whether you’re planning for retirement, dealing with a significant life event or simply looking to make smarter financial decisions, a financial advisor can offer the expertise and guidance you need. Here are some compelling reasons why you should consider a financial advisor — even if you’re not wealthy.

Review Tax Strategies

“Harris may propose tax changes, potentially increasing rates for higher-income earners,” Calio said. “Reviewing tax strategies now could help mitigate future tax liabilities, such as maximizing contributions to tax-advantaged accounts, considering Roth conversions, RMD planning or strategically planning the sale of highly appreciated non-qualified assets — investments, businesses, rental properties etc.”

If you’re a high-earner, it could be a good idea to create a tax plan now that aligns with potential Harris administration tax changes. This way, if she wins the election, you’ll already have a plan in place to keep your tax liabilities to a minimum.

Learn More: I’m an Economist: Here’s My Prediction for the Housing Market If Trump Wins the Election

Evaluate Healthcare Options

“Harris has supported expanding healthcare access, which could impact insurance markets and costs,” he said. “Evaluating current healthcare plans and considering options like Health Savings Accounts (HSAs) could be beneficial.”

During her 2019 presidential run, Harris proposed a Medicare for All system that would give all Americans the option to immediately buy into Medicare. She also planned to expand the Medicare system over a 10-year phase-in period.

It’s currently unknown what her plans for the healthcare system are if she’s elected president. Stay tuned as she announces more about her healthcare platform for this campaign.

Consider Estate Planning

When she ran for president in 2019, Harris proposed a more progressive income, payroll and estate tax for corporations and the top 1% to help fund her Medicare for All plan. It’s unknown if her current campaign will take this approach, and even if it does, 99% of Americans would be unaffected.

However, it could still be a good idea to place your attention on estate planning, since the future estate tax situation is unknown. This can provide peace of mind and the potential to maximize your estate.

“Potential changes in estate tax laws could affect inheritance strategies,” Calio said. “Consider accelerating your gifting strategies now — e.g., shifting assets out of the estate using irrevocable trusts, estate freezing techniques, cash gifts to your heirs, etc. — while your estate/gift tax exemption limit is higher.”

Evaluate Using Home Equity as a Funding Method

“After the sunset provision, interest tied to home debt will be deductible — subject to limits — even if it was not used to buy, build or improve your home — i.e., deductible interest is no longer required to be tied to ‘acquisition debt,’” Calio said.

Given this, it could be a good idea to use your home as equity, if you’re in search of funding.

“These moves are speculative and based on potential policy directions,” he said. “Consulting with a financial advisor for personalized advice is recommended.”

Assess Investment Portfolios

“Changes in administration often lead to shifts in market sectors,” Calio said. “Reviewing and possibly reallocating investments to sectors likely to benefit from Harris’s policies — e.g., renewable energy, technology, ESG — could optimize returns.”

Additionally, he you need to consider the tax implications of your returns.

“You should also determine the extent to which your non-qualified portfolio income might increase your overall tax liability after the sunset provision,” he said. “Consider whether it may be appropriate to shift more of your allocations to holdings that have favorable tax treatment — e.g., municipal bonds, qualified dividends, long-term capital gains, etc. — or funds with lower turnover — e.g., fewer capital gains distributions — in 2026, but be mindful of the potential tax implications of rebalancing.”

Buy Tech Stocks

Further emphasizing Calio’s advice to assess your investment portfolio, Noah Damsky, principal at Marina Wealth Advisors, agreed that focusing on the technology sector could be a lucrative move.

“If [Harris] wins the election, technology stocks are a buy,” he said.

So far, signs point to Harris maintaining the Biden administration’s China policy if she’s elected president, according to Politico. This could be important for tech stocks.

“She will not be as tough as Trump on China, so a less contentious U.S.-China relationship will be good news for technology companies that do business in China,” he said. “She will be less likely to rock the boat and stir trouble that could lead to a trade war.”

Therefore, investing in tech stocks could be a good idea, if you’re confident Harris will be elected president in November.

Editor’s note on election coverage: GOBankingRates is nonpartisan and strives to cover all aspects of the economy objectively and present balanced reports on politically focused finance stories. For more coverage on this topic, please check out I’m a Financial Advisor: 4 Moves I’ll Make If I Think Trump Will Win the Election.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: I’m a Financial Advisor: 6 Moves You Should Make If You Think Harris Will Win the Election

6 Moves You Should Make If You Think Harris Will Win the Election #Moves #Harris #Win #Election

Source Link: https://finance.yahoo.com/news/m-financial-advisor-6-moves-110135063.html

6 Moves You Should Make If You Think Harris Will Win the Election – Notice Important Web

#Finance – BLOGGER – Finance, election, Harris, Important, moves, Notice, Web, win